Prerequisites

Connection Methods

API Key Connection

Connect using Stripe's restricted API keys with read-only permissions for secure data access.

Webhook Integration

Optional webhook setup for real-time payment event monitoring and alerts.

Connection Guide

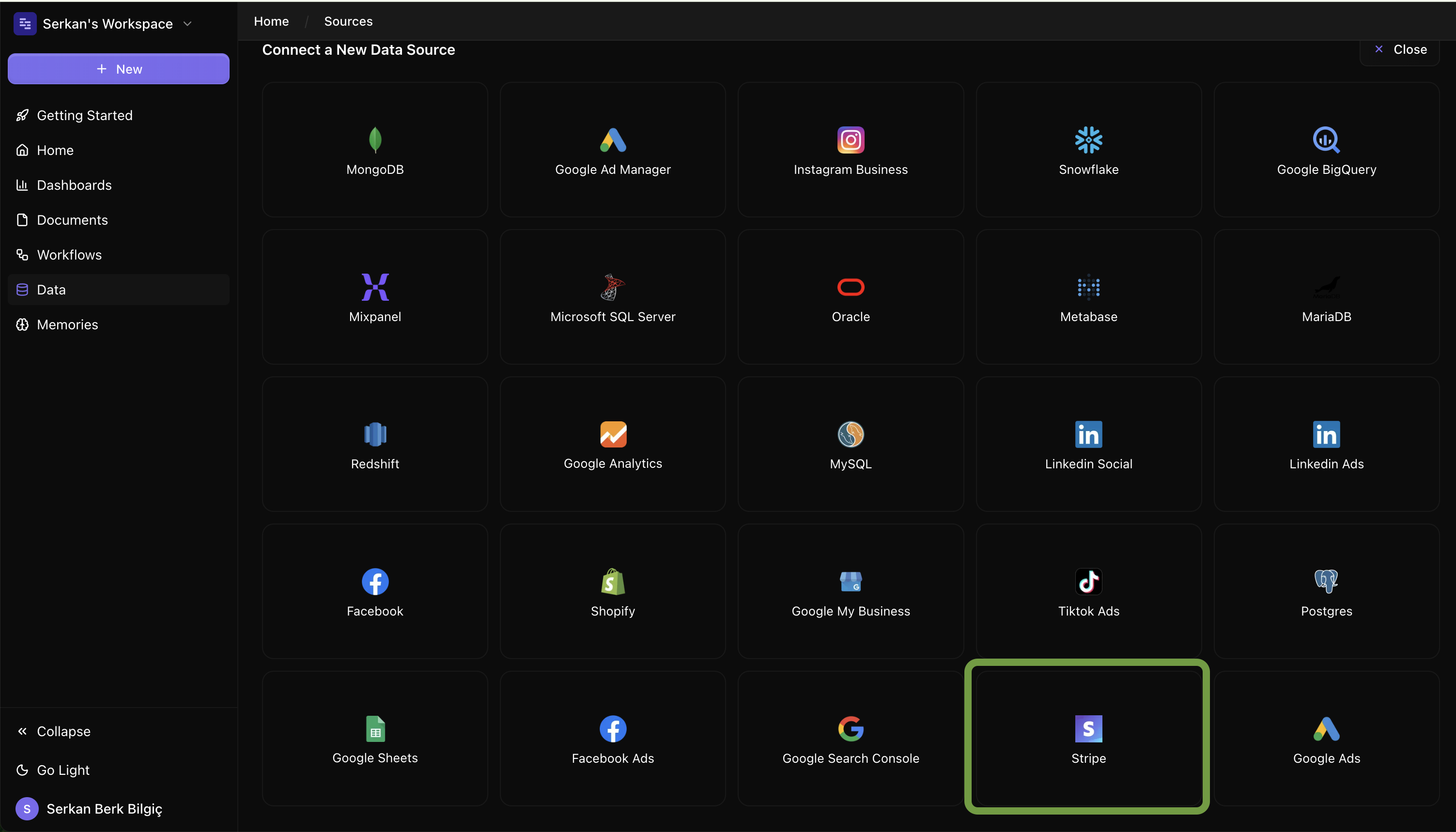

Step 1: Access Stripe Integration

Navigate to Integrations in Datapad and select Stripe:

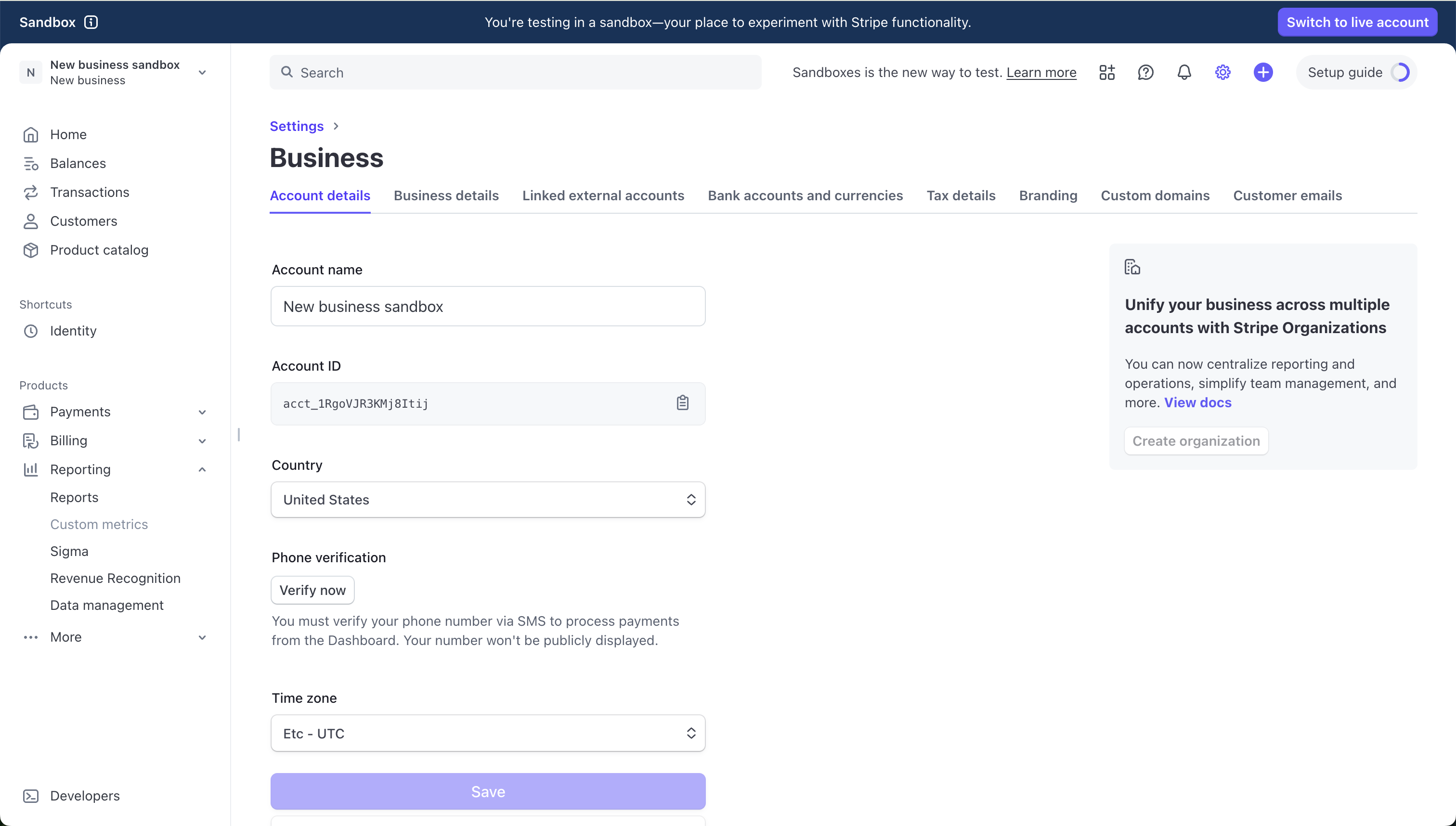

Step 2: Get Stripe Account Id

In your Stripe dashboard, copy your account id for Datapad:

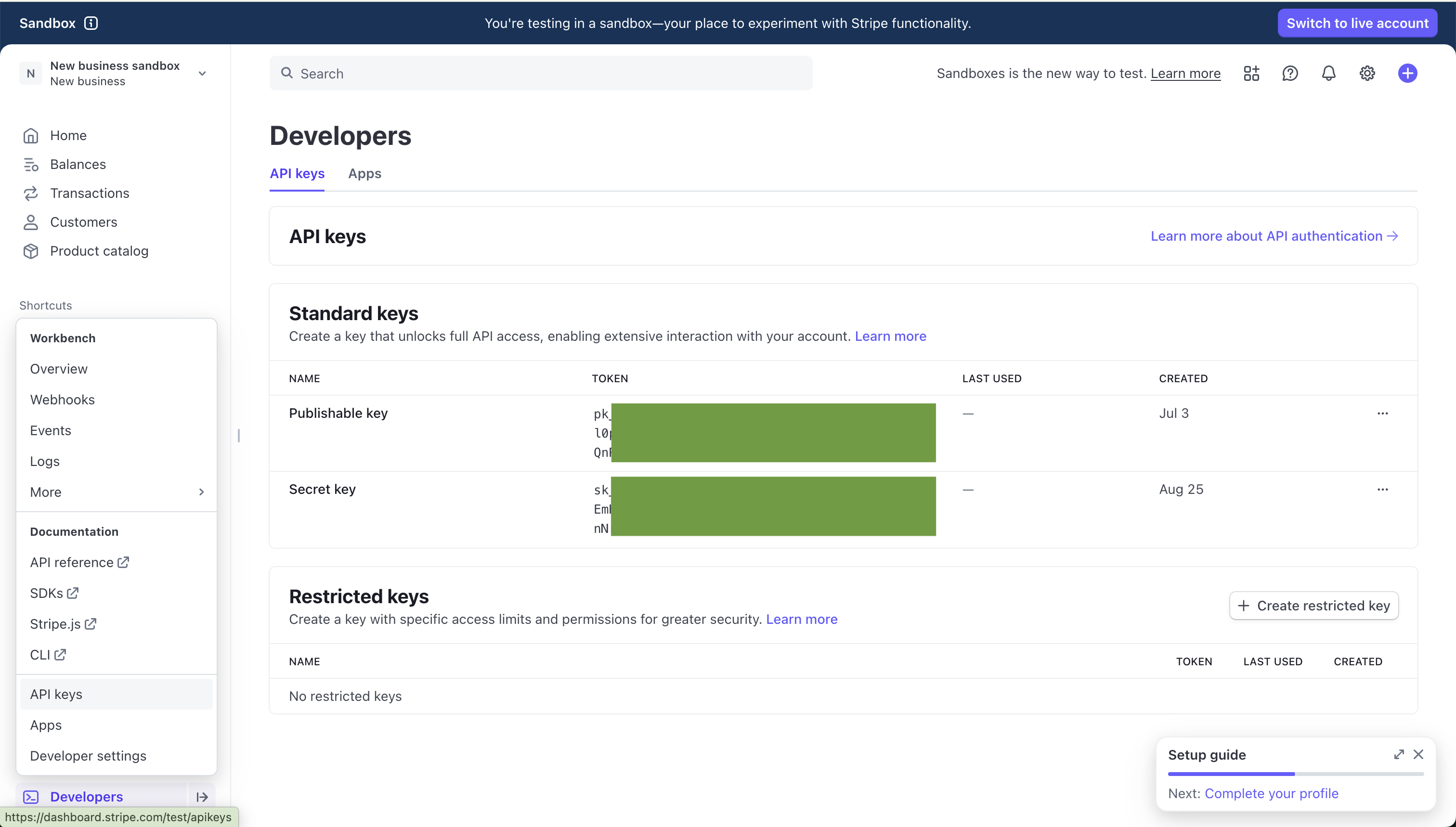

Step 3: Create API Key

In your Stripe dashboard, create a an API key for Datapad:

Required Permissions:

- Read access to charges and payments

- Read access to customers and subscriptions

- Read access to invoices and payment intents

- Read access to disputes and refunds

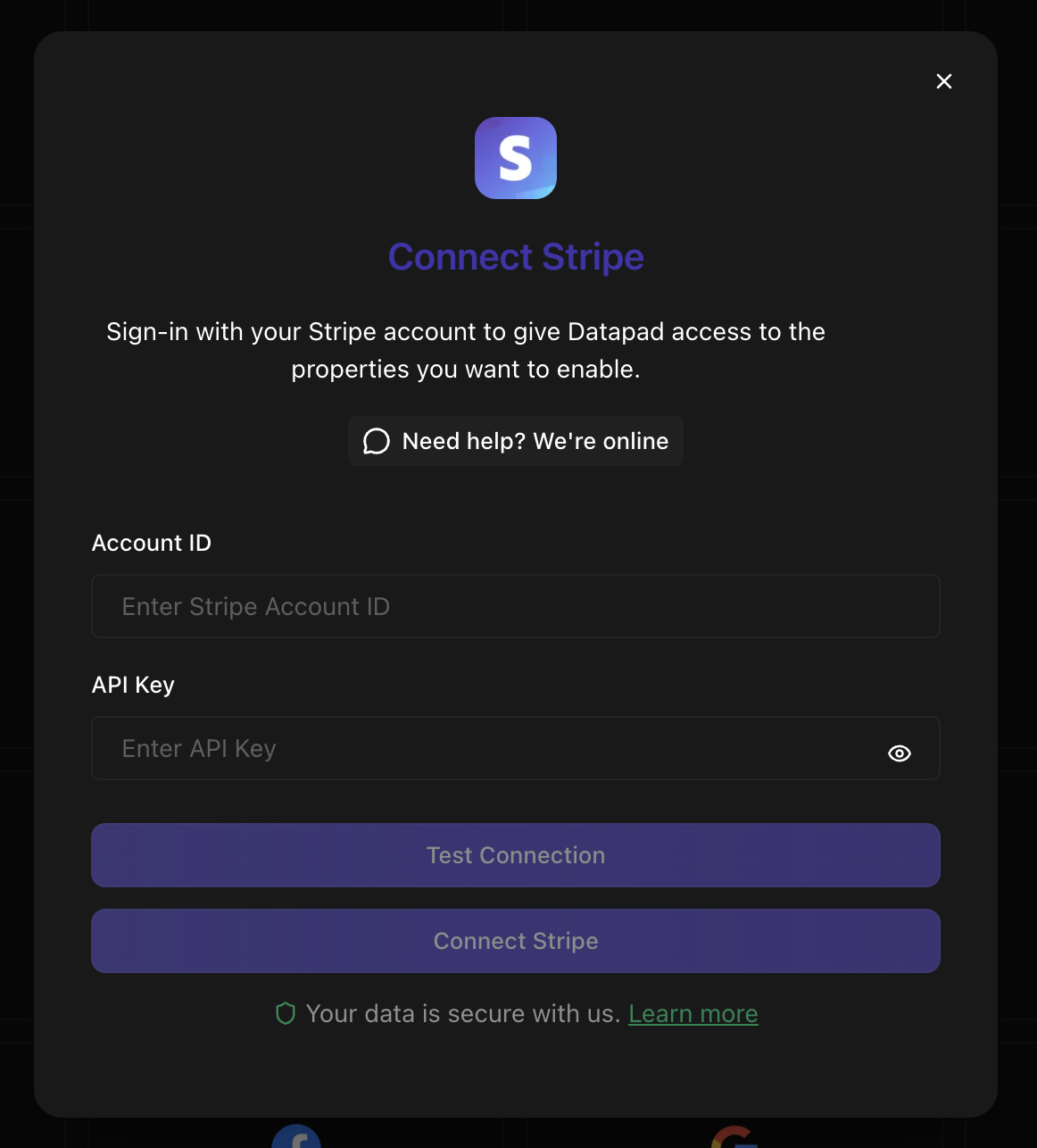

Step 4: Enter API Key in Datapad

Paste your restricted API key into the Datapad connection form:

Connection Details:

- Stripe Account Name

- API Key

Example Queries

Here are some example questions you can ask once your Stripe data is connected:

💬 Payment Optimization Tips

Behind the Scenes

Datapad connects to the Stripe API to fetch your payment data, subscription information, and customer behavior patterns. Our AI analyzes payment success rates, identifies churn risk factors, and provides specific recommendations for optimizing revenue flows and reducing payment-related losses.

Troubleshooting

API key authentication failed

If API key authentication fails:

- Verify the API key is correctly copied from your Stripe dashboard

- Ensure the API key has the required read permissions

- Check that the API key hasn't been restricted or deactivated

- Try creating a new restricted API key with proper permissions

Missing payment data

If payment data is missing:

- Verify your Stripe account has sufficient transaction history

- Check that the API key has access to all required resources

- Ensure payments are being processed through your connected Stripe account

- Contact support if specific payment types or periods are missing

Subscription analysis incomplete

If subscription analysis is incomplete:

- Verify Stripe Billing/Subscriptions is enabled in your account

- Check that subscription data includes sufficient customer history

- Ensure subscription events are being properly recorded in Stripe

- Review webhook configuration if real-time analysis is needed